Workflow management is holding you back

One only need look at the billions of dollars of SEC fines each year to see that financial institutions are struggling to track and report data to meet their regulatory and internal reporting needs. But regulatory fines are the tip of the iceberg in terms of the impact of your business being unable to easily manage data workflows.

- Business interruption and losses

- Inability to launch new products

- Delayed response to market conditions

- Challenged to proactively manage risk

Xinthesys makes workflows easy

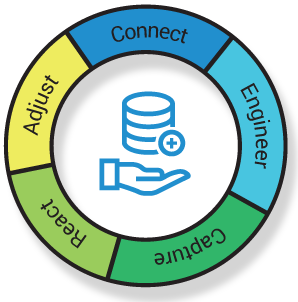

Xinthesys’ platform enables business users to easily create, test and deploy new workflows to meet regulatory and internal needs.

Connect: Connect your disparate data sources to the platform using secure APIs. Easily connect both new cloud legacy systems and databases.

Engineer: Configure your data to meet and transform your business needs. Apply off-the-shelf workflows for standard industry reporting or self-configure for custom reporting.

Capture: Automatically store all trade data in a dedicated transaction and event location. The platform supports all private and shared clouds as well as on-premise preferences.

React: Configure alerts for specific events or thresholds. Reliably determine in real-time if your governance processes and regulatory requirements in compliance.

Adjust: Adapt your processes and thresholds in real-time to meet new market conditions. Effortlessly conduct scenario analysis on potential changes before deploying changes.

Xinthesys offers two functional options

Off-the-shelf data workflows

Leverages preexisting, compliance focused workflows for (click each title to reveal more):

SEC Rule 605 Trade Statistics Reporting

SEC Rule 606 Order Routing Reporting

SEC Rule 611 Inferior Price Reporting

Off-the-shelf workflows are offered through a managed services model, where Xinthesys hosts the data and provides a white-gloved data integration support.

Client-developed WorkflowsUse the same Xinthesys platform to create your own proprietary workflows. As a software-as-a-service solution, clients can easily create workflows to meet their own internal governance frameworks as well as to build new products. A full range of dedicated and hybrid cloud storage options are available for client needs.

Our mission is to end your data challenges

Make data workflow management problems a thing of the past. Whether it’s creating comprehensive trade stores or simply finding a better way to connect and manipulate your organization’s data, our mission is to make it easy, cost effective, and scalable for your business today — and in the future.

Xinthesys was founded by a team of senior technologists who have spent over 20 years solving these data challenges in some of the largest financial institutions in the world. Frustrated by the complicated and rigid approaches, the team founded Xinthesys to provide a unique, agile, best-in-class data workflow solution.